Customers sometimes send sensitive information, such as their credit/debit card number, when trying to complete a transaction. In Gladly, valid credit/debit card numbers are automatically redacted for security purposes.

How credit/debit card number redaction works #

Gladly uses the Luhn algorithm to identify if a credit/debit card number is valid and not just a random sequence of numbers. Still, it doesn’t guarantee that every credit/debit card number will be identified.

When a Customer types their card number, we redact the number before it leaves the browser but only after hitting Enter. We do not attempt to redact as they type the number in the composition field. Card payment information stored as a Note will also be redacted.

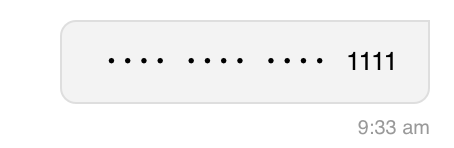

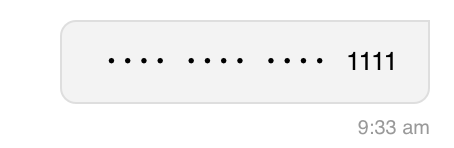

Once identified as a credit/debit number, it’s redacted from the Conversation. It will look like this:

Automatic redaction of credit/debit card numbers applies to all text-based Channels (e.g., chat, email, and SMS) and Notes.

Why some credit/debit card numbers are not redacted #

It will not be redacted if the number is not a valid credit/debit card number.

Credit/debit card number collection over the phone #

Agents would sometimes process payments over the phone. Instruct Agents to pause the call recording when discussing sensitive personal information such as credit/card information. Messages containing sensitive information can also be deleted.