Payments key features #

PCI Compliant

Payment information is passed through a secure tunnel. Gladly is PCI DSS Level 2 compliant.

No Integration Required

No costly integrations are required with 3rd party systems. Start using Gladly Payments as part of your current order process.

Real-Time Updates of Actions

Agents can see when the Customer has finished entering their information or if they decline payment.

Credit Card Masking

Information is automatically masked if a Customer accidentally enters their credit card information through the regular chat window.

Configurable Time Limits

Only the Agent who requests the credit card information can view it for a specified period of time.

Revenue Reporting

Reports to understand revenue by Agent and overall revenue generated by the contact center.

Mobile App Support

Accept chat payment through your mobile app using our mobile (iOS/Android) SDK.

How Payment works #

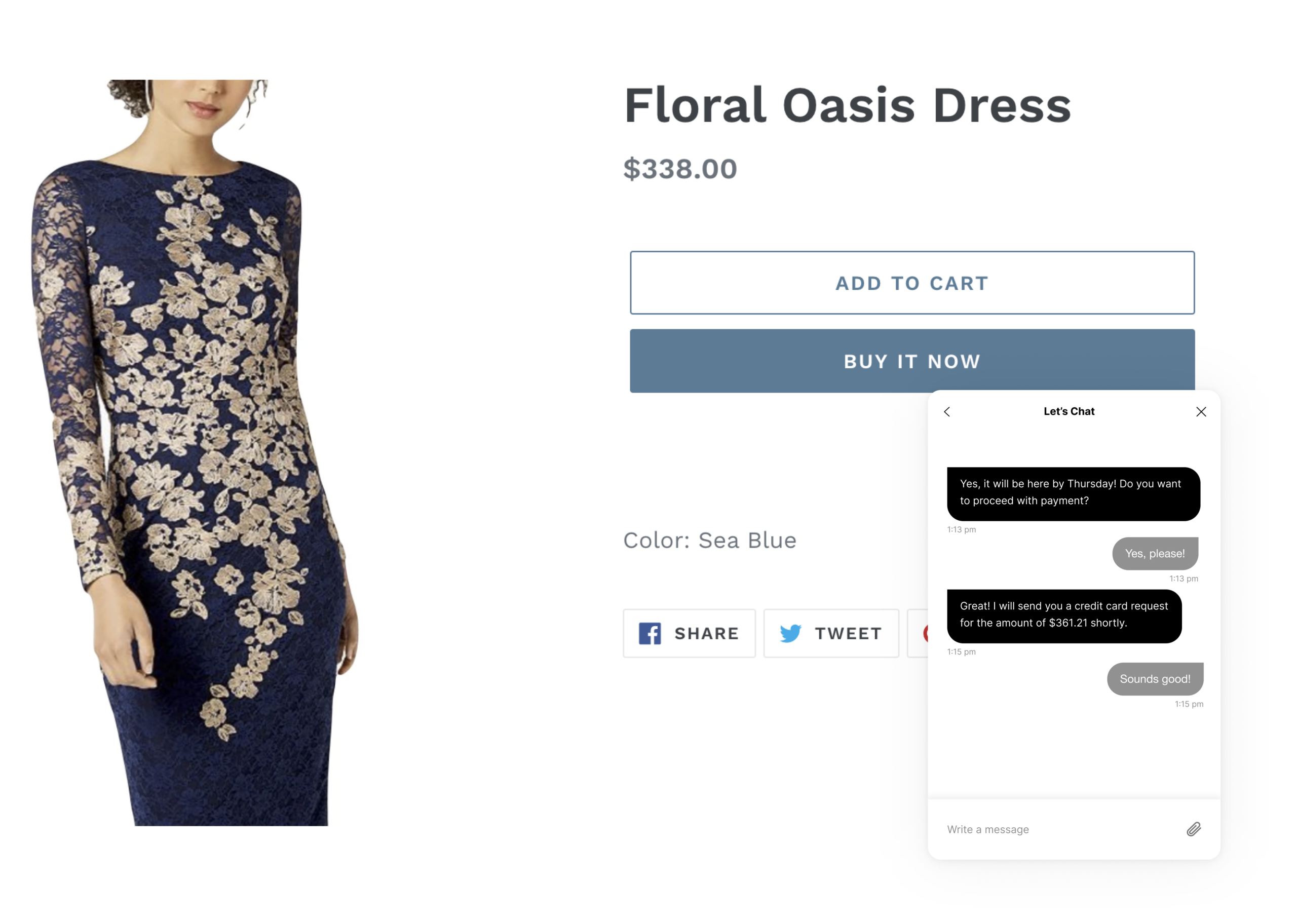

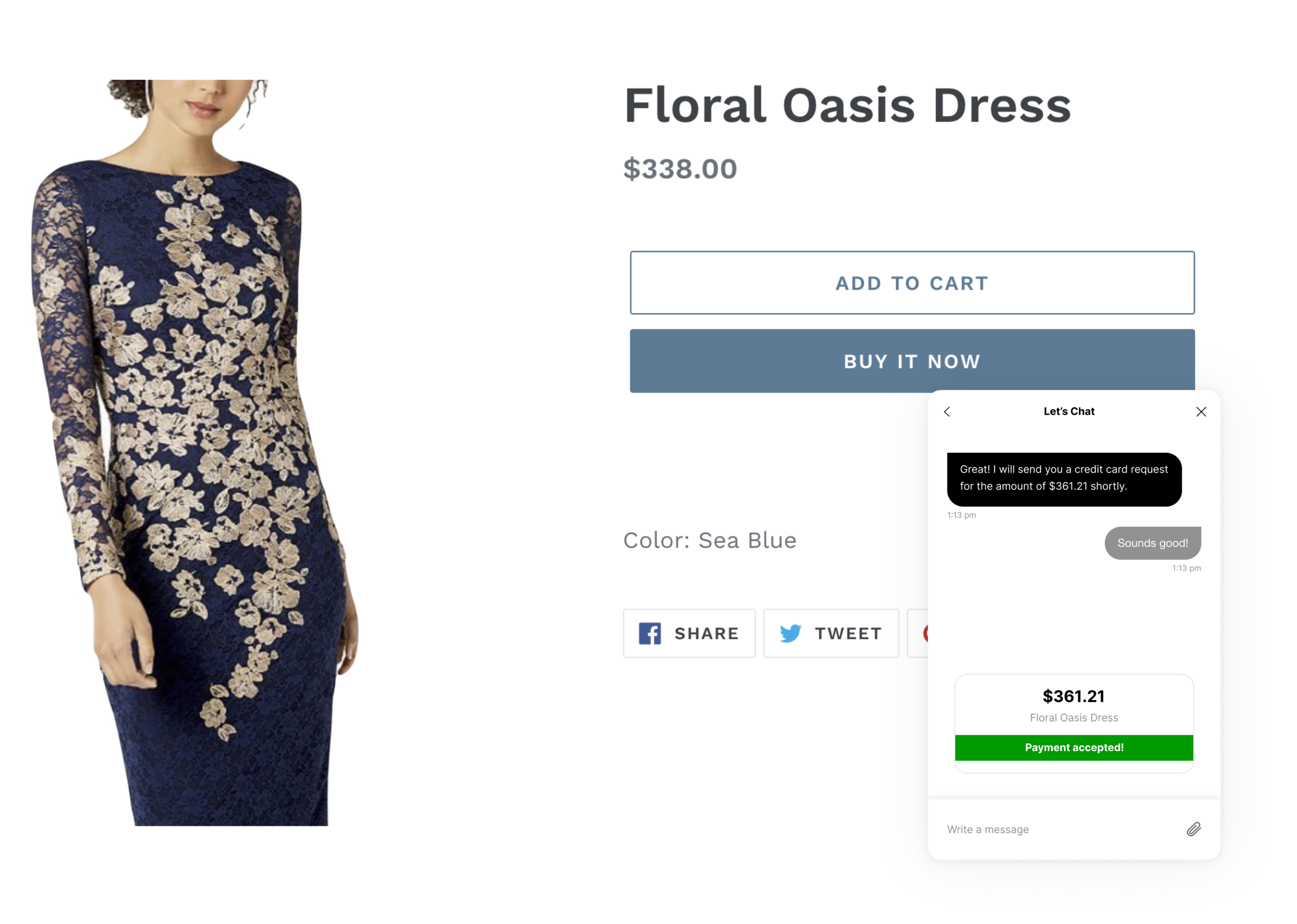

- Request payment – If your Agents are Chatting with your Customer online, and they are wondering if a dress will arrive in time for their anniversary after you confirm that they can, you can have them complete the purchase right where they are. There is no need to direct them through the purchase flow or checkout page; the transaction can be completed with you.

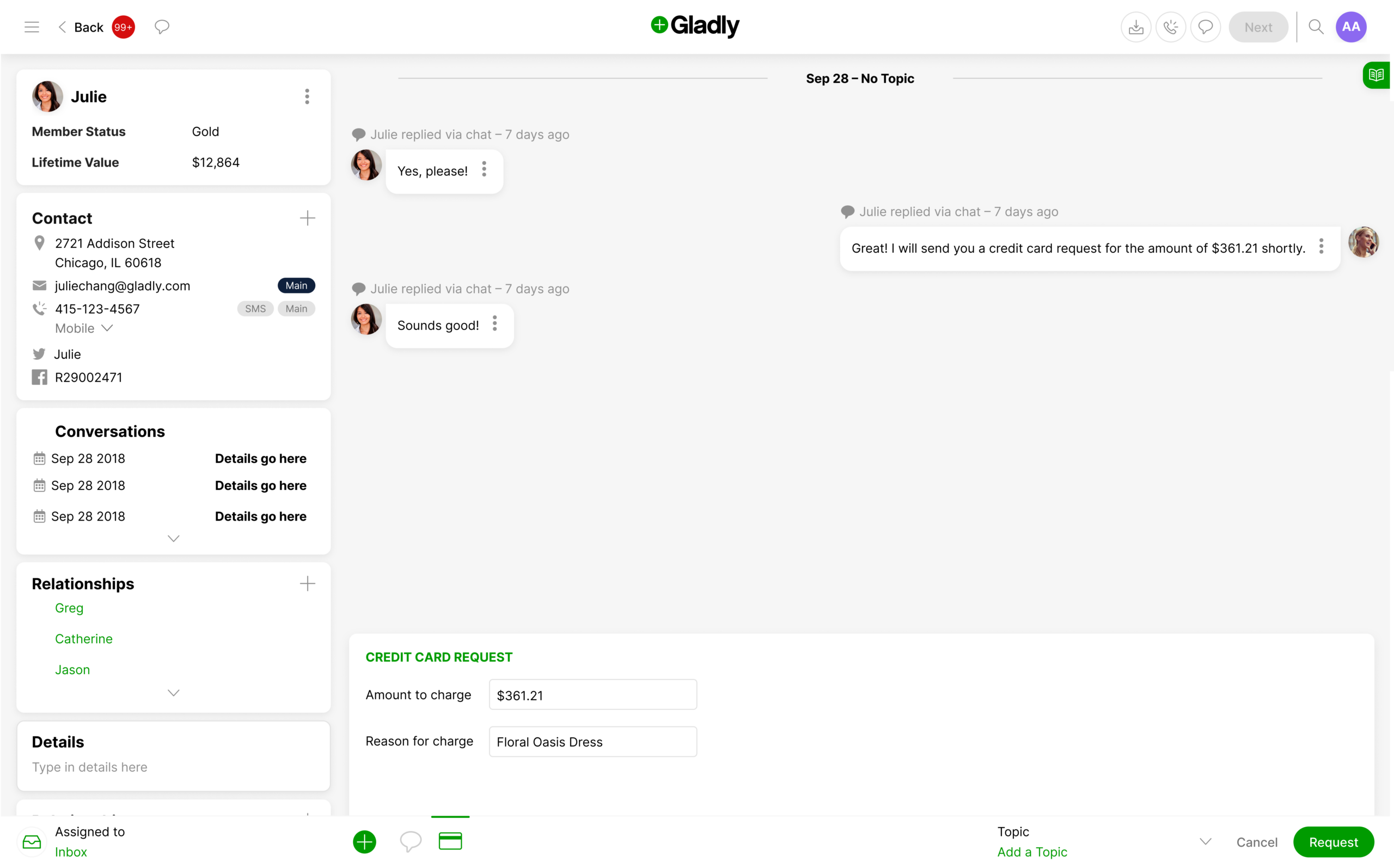

- Complete Credit Card Request Form – Once your Agent receives your Customer’s approval to move forward with the transaction, all they need to do is fill out the simple and secure credit card request form, including the amount and reason for the charge. This is done right in Gladly, so you don’t need to switch to another processing platform to take their payment.

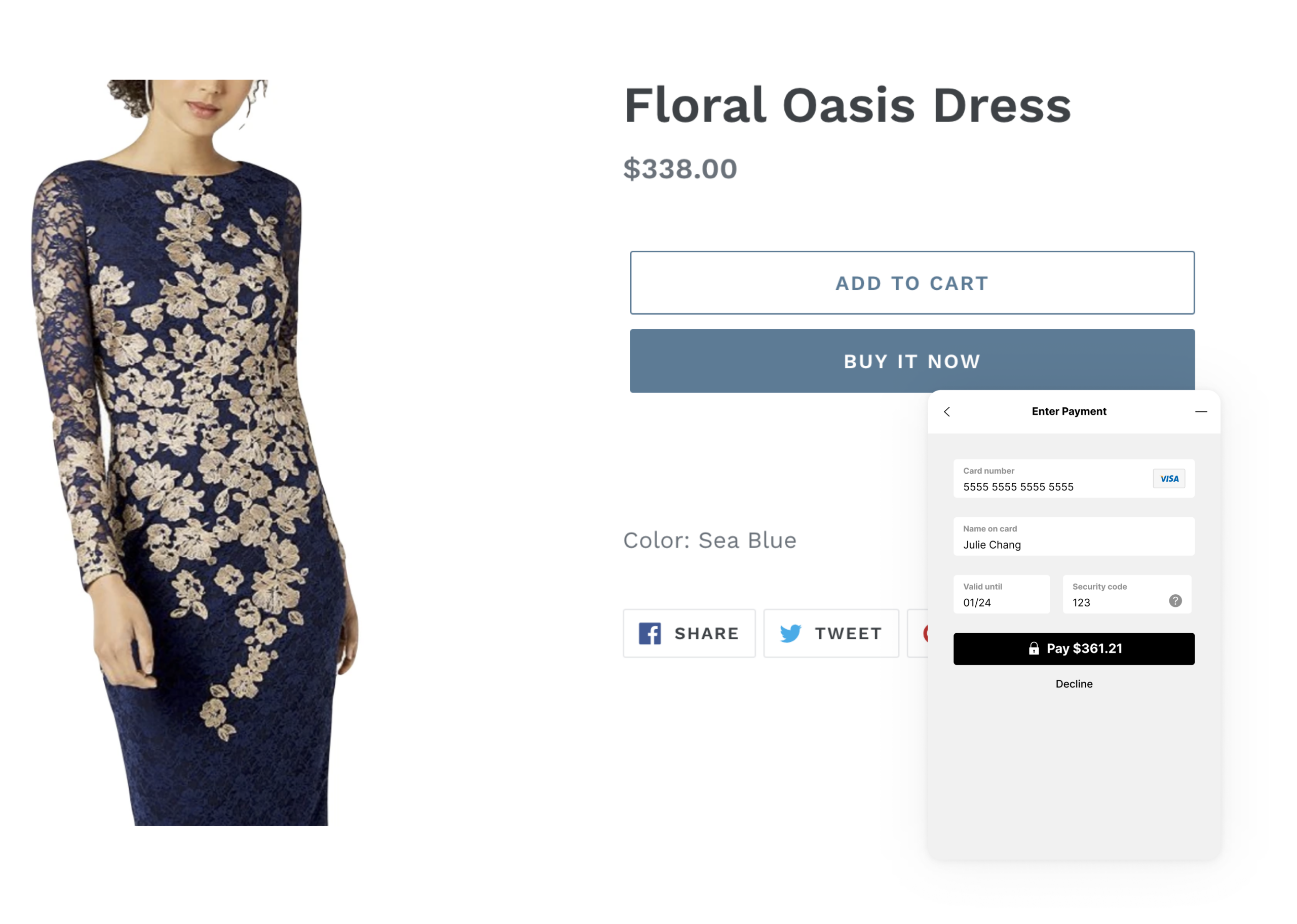

- Customer submits payment information – After your Customer clicks Enter Payment, they would fill out their credit card information. Right Away, they will notice the web collection form is similar to what they are used to — simple and secure. They can still decline payment if needed by clicking Decline; otherwise, they would proceed and click Pay.

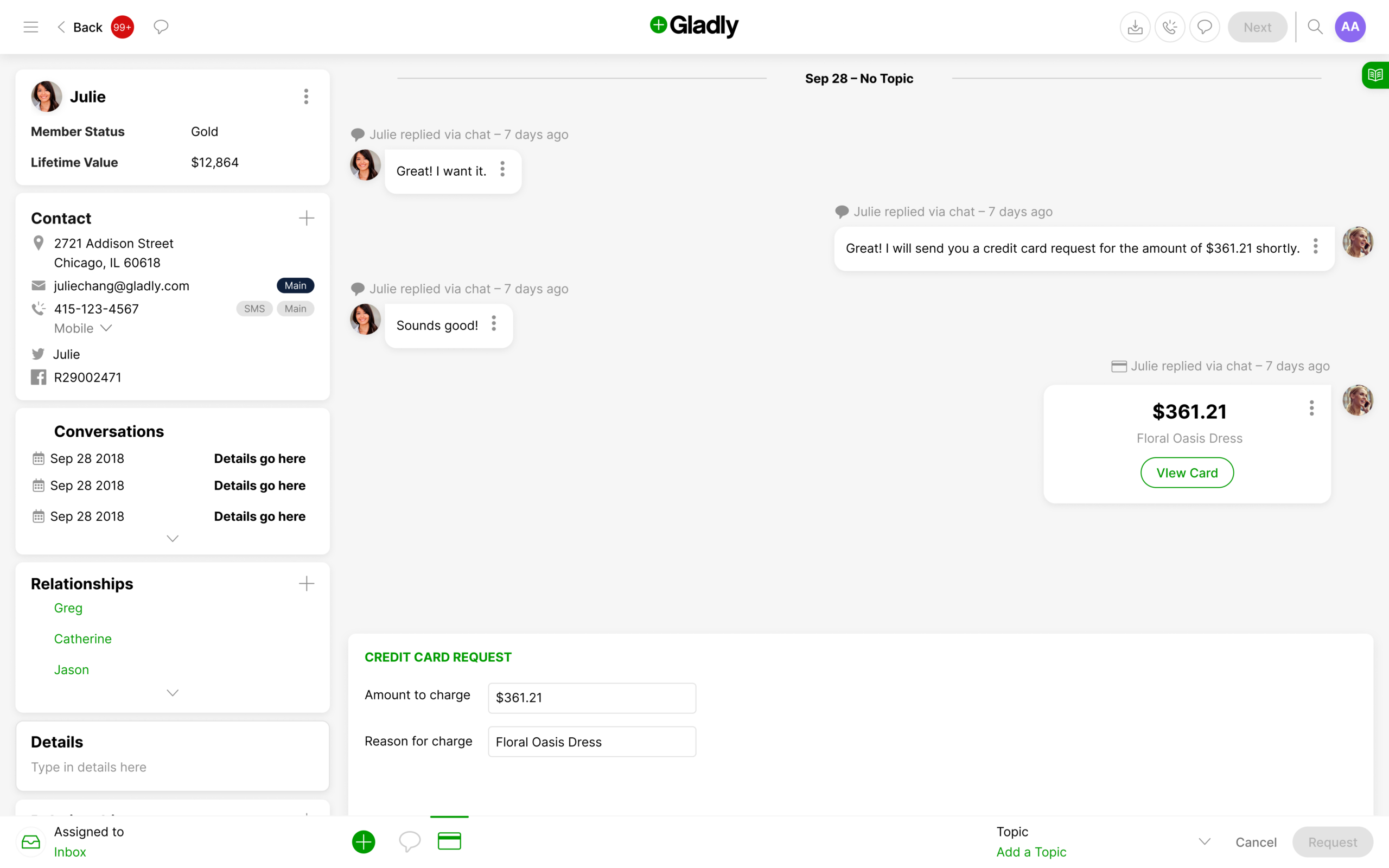

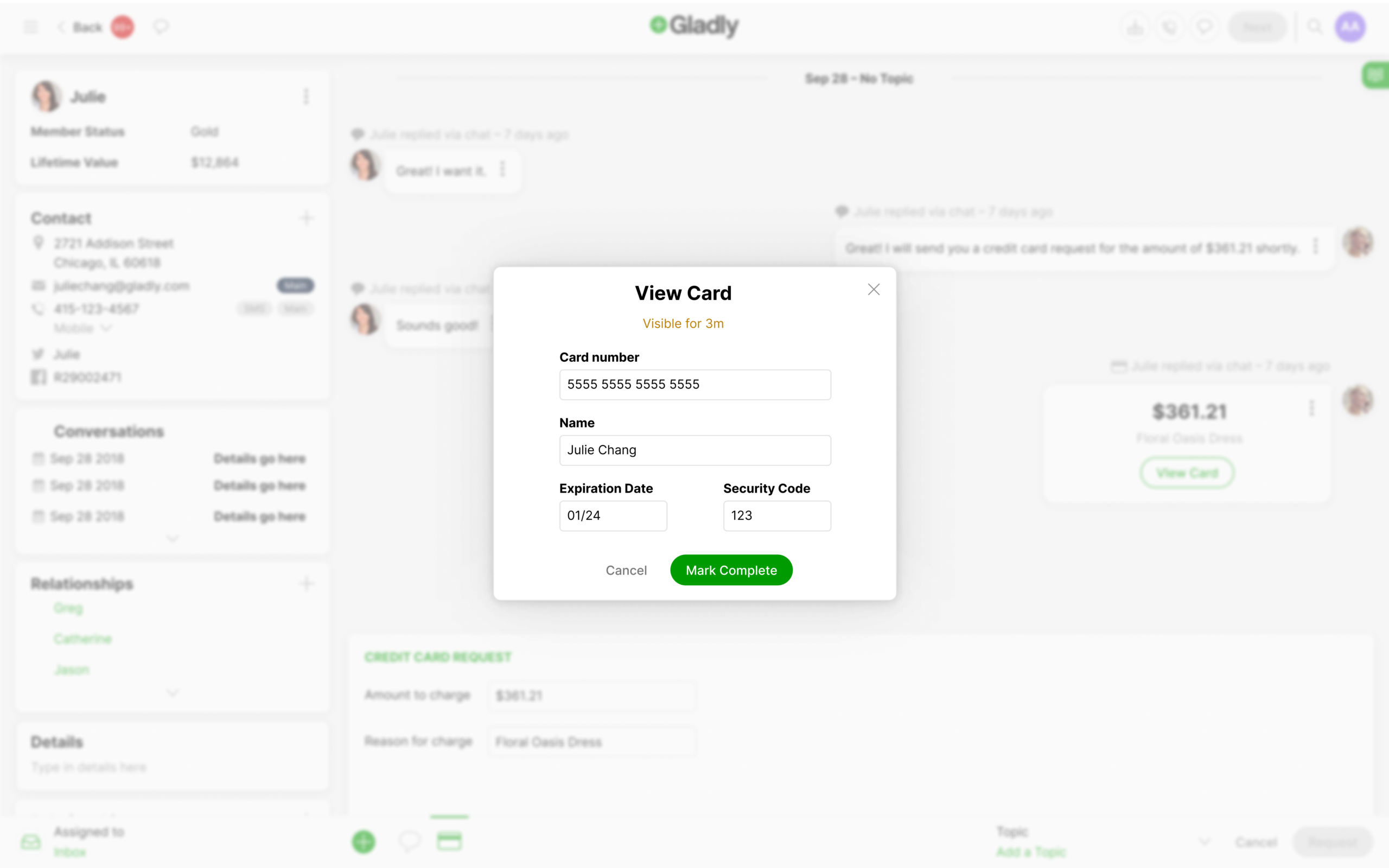

- Receive payment information – Your Agent would then see payment information in Gladly, just as you would any other inbound communication. This helps them keep track of the messages and all payment requests — keeping everything tied to the Customer in case they need to go back and reference something.

- Payment details are inputted into the existing 3rd party credit card processing system – Similar to how transactions are captured through Voice today, you would copy and paste the information into an existing payment processing system. Credit card information appears only for a short period of time and is only available to you (no other Agents can see this). The time shown is also configurable by you, and no Customer credit card information is ever saved in Gladly. Gladly is PCI DSS Level 2 Certified.

- Customer is notified – After the payment details are entered into your existing credit card processing system and are marked complete, information is automatically wiped and unavailable for your Agent to see. The information is automatically wiped if the transaction is incomplete but the configured time has elapsed.

- Transaction is completed – After the transaction, your Customer will receive an order confirmation, and the payment activity will be saved in the Conversation Timeline. While Agents can’t see the transaction’s payment details, they can see that something was purchased through a Messaging Channel. This arms them with the context in case they need to reach out again.

Activate Payments #

- Contact Gladly Support or your CSM to activate Payments in Gladly.

- See Collect Payment Over Chat to learn how Agents collect payment over chat.